Health Insurance Premium Calculator: Calculate Health/Mediclaim Policy Premium Online – Royal Sundaram

Health Insurance Premium Calculator

With the rising medical costs, the most effective way to secure your future as well as your family’s future is to buy a health insurance cover. Buying a health insurance is an imperative step that you can take so as to protect yours and your loved one’s health. It gives you coverage against heavy medical expenses that may arise due to any sickness or health injury.

Health insurance policies are designed to provide wider health coverage so to reduce the burden on finances during medical emergencies. There are several different types of health insurance policies available in India. So, before buying the health insurance plan, it is beneficial to read the list of coverage, exclusions and waiting period.

Likewise, calculating the premium is also very important. If you own a health insurance policy, you have to pay some amount of premium to an insurance company every year so that in case you meet with an accident or have to undergo a surgery or operation, the insurer will pay you on his behalf. Thus, health insurance premium calculator helps you to compare several plans based on your requirement. Though, there are several other factors that need to be considered while choosing the best health insurance plan. It also helps you to arrive at an estimate price of the health insurance plan you can consider for purchase.

Health Insurance Calculator

A health insurance calculator is an online tool that helps you to know the premium amount you need to pay for your health insurance premium. In simple terms, health insurance premium calculator facilitates you to calculate health insurance premium, based on your needs. With the help of health insurance premium calculator, you can choose the best health insurance policy at an affordable price and get the policy issued to you in a short period of time. In addition to this, you need to know that health insurance premium calculator is based on several factors. And several insurance companies have their own pre-deciding factors like your age, pre-existing disease or individual as well as family history. With this calculator, you will be able to calculate the premium of top health insurance plans. Though health insurance premium calculation is a tedious task as there are several different parameters involved in it. But you can easily do the same by taking help of a health insurance premium calculator.

How to use health insurance premium calculator?

To start using a health insurance premium calculator, all you need to do is to fill in all the personal details in your form along with other details. Based on the information offered by you, you will get an estimate of the premium and also you can easily compare your health insurance quotes.

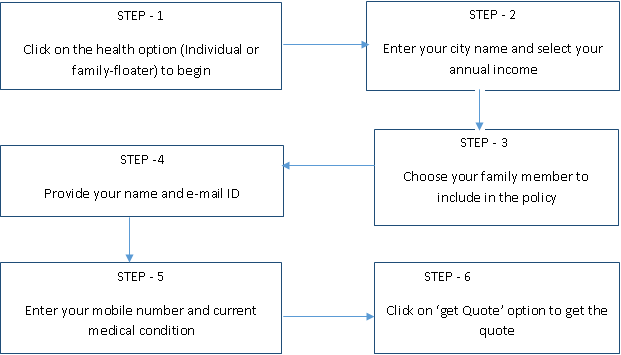

Here’s a step-by-step guide that will help you in this regard –

What is the need of health insurance premium calculator?

The below mentioned reasons will make you understand the need of a health insurance premium calculator –

- It helps you to plan your finances easily as you get to know your tentative premium amount in advance. Also, you can learn about the part of your monthly expenses that you need to manage towards paying your premium amount.

- Several health insurance policies are suggested by online insurance premium calculators. You can compare these policies to choose the best health insurance product. This will help you to ensure that all your needs are fulfilled apart from getting an insurance premium quote.

- Health insurance premium calculator helps in making premium calculation a simple and quick task.

Benefits of Health Insurance Premium Calculator –

The following are the benefits of health insurance premium calculator:

- With the help of a health insurance premium calculator, you can estimate of the premium prior to buying the policy

- You can choose a health insurance plan easily based on the comparison between several different insurance plans

- You can take your own decision as you don’t need to go and meet an insurance agent

Factors Affecting Health Insurance Premium

Each insurance company applies few specific guidelines to finalize the premium for several health insurance policies. Take a look at the list of factors that affect health insurance premium –

-

Mortality rate:

Mortality rate is the cost that an insurance company has to bear in case of eventuality to the customer. The expenses of mortality changes for several age groups as well as income groups and is usually high for old customers. -

Personal history:

An insurance provider may or may not conduct medical check-ups before an individual avails health insurance policy. Although, insurers do take into account a person’s health, his/her family medical history, personal habits such as drinking, smoking at the time of availing health insurance policy. All of this information plays an important role in deciding the policy premium at the time of availing a medical insurance policy. -

Savings part:

It is the section of premium that is put into various public investments. These investments are created on the guidelines issued by the Insurance and Regulatory Body of India (IRDA). You can calculate health insurance premium based on the return of this capitalization.

With the growing number of diseases, owning a health insurance plays a leading role with regard to one’s security. So use a health insurance premium calculator and choose the best health insurance policy at an affordable price. Royal Sundaram’s health insurance premium calculator lets you calculate premium and quotes online for an individual insurance or family floater health insurance by following a few simple steps.

Back

Back